What This Article Is About

Artificial intelligence is fragmenting the traditional value chain across multinational enterprises (MNEs). Where models are trained, tuned, and deployed is often distinct from where they evolve and generate commercial value. This challenges legacy transfer pricing frameworks, which rely on legal ownership, static functions, and comparable market benchmarks. As AI systems become more decentralized, modular, and democratized, companies should rethink how value is defined, allocated, and defended within and across borders. This article explores how legacy principles like DEMPE, CWI, and intangibles are being tested by evolving AI models—and offers companies practical considerations for updating their transfer pricing approaches in light of new technologies and decentralized value creation.

(If you missed my last article, When AI Works, Who Gets Paid?, it introduced the AI value chain and opened the door to this deeper dive on how transfer pricing frameworks are being tested in real time.)

Why This Matters

We’re in the “1996 moment” for AI—facing foundational questions about attribution, governance, and value that mirror the early expansion of the internet. Back then, tax systems struggled to keep up with the rise of digital business models that scaled globally without establishing a meaningful local presence. The “fair share” debate emerged in response—asking how digital value should be taxed when it doesn’t respect national borders. The international tax community responded first with “BEPS 1.0,” and later with a two-pillar solution—one that has struggled to gain global consensus and remains only partially implemented, with ongoing challenges around enforcing the global minimum tax.

In the time it has taken to debate and design these tax reforms, AI has advanced faster than anyone imagined. From AlphaGo and transformer models to ChatGPT, copilots, and autonomous agents, the pace of innovation since 2013 has been exponential. Today, AI is moving at lightning speed—outpacing the ability of governments to regulate or tax it coherently. As AI accelerates faster than tax rules can evolve, companies are left to fill the gap—developing their own transfer pricing policies amid foundational questions of attribution, governance, and value that echo the early challenges of the digital economy.

Now, AI is bringing that debate full circle. If a model is designed in one country, enhanced in another, and monetized globally—how should profits be split? Who owns the intelligence? Who controls it? Transfer pricing, long the gatekeeper of cross-border income allocation, is being pushed into uncharted territory.

“AI isn’t just a better search tool—it’s completely rewriting how information flows. We’re shifting from the chaos of the open web to the centralization of information. It’s like the ‘totalitarianism of search’—one answer, one authority, controlled by algorithms we can’t see. And if history has taught us anything, it’s that whoever controls the flow of information controls everything.”

— Mehdi Daoudi, CEO and cofounder, Catchpoint

Mapping the AI Value Chain Within an MNE

There is no advanced GPS for AI value attribution—no Google Maps for functional analysis and risk (FAR) assessment. What we have today is more like early MapQuest: directional, but far from fully routed. AI is evolving faster than any of us could have anticipated, so it’s impossible to know exactly where it’s headed and when it’s going to get there. What’s more, the pace of change is accelerating. GPT-5 is expected to launch in 2025 with capabilities that could fundamentally reshape how we think about AI deployment and value creation. As we move closer to artificial general intelligence (AGI), the challenge becomes even more complex: how do you value an asset when you can’t predict its next evolutionary leap? Traditional intangible valuation assumes some degree of technological stability, but AI systems are advancing so rapidly that today’s benchmarks may be obsolete within months.

So let’s start where we always start – with the value chain.

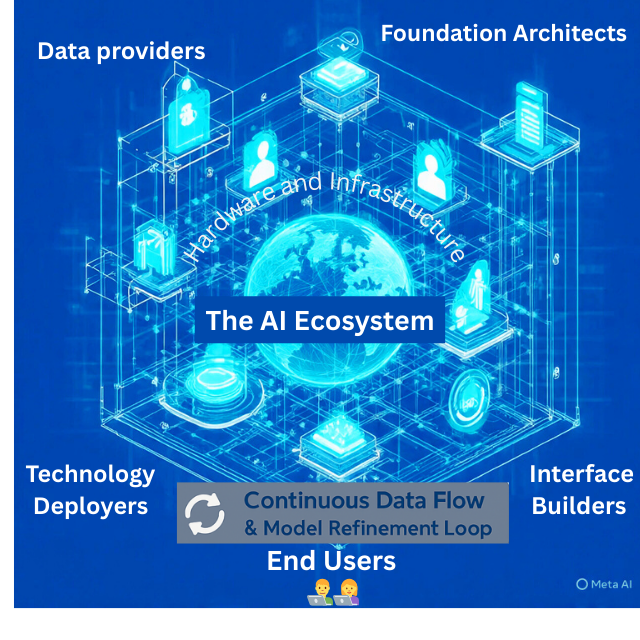

To apply transfer pricing rules, companies must first understand the full AI value chain—not just the outputs, but the overlapping roles of internal teams, technologies, and jurisdictions. A simplified model looks like this:

- Data Providers – A U.S. analytics team prepares and labels proprietary customer data for model training

- Compute & Infrastructure Providers – A Singapore-based cloud affiliate provides access to high-performance GPUs and colocation services, without which training would be impossible (in many cases, this would be outsourced because of the high barrier to entry for this market, but procurement and expertise associated it would be necessary)

- Foundation Architects – An Irish R&D entity develops and trains general-purpose models on shared cloud infrastructure

- Technology Deployers – A German subsidiary fine-tunes the model for legal services, adapting it to local case law and regulations

- Interface Builders – A Latin American affiliate builds the front-end application and prompt pipeline for client use

- End Users – Global teams interact with the AI system, generating data that continuously refines model performance

These activities often span related parties within a multinational group—making value attribution a functional, not merely legal, exercise.

Which leads to the next question: what are we valuing, exactly? While AI has been around for decades, today’s models mark a turning point. From symbolic reasoning in the 1950s to machine learning in the 1990s, AI has evolved in waves—but the rise of deep learning and generative models like ChatGPT represents a new era. Often called the Fourth Industrial Revolution, this phase is defined by AI systems that don’t just analyze data—they generate code, content, and strategy.

As AI embeds itself deeper into business processes, traditional approaches to classifying and valuing intangibles are under pressure.

What Qualifies as an Intangible?

Across the AI startup ecosystem, internal tools are rapidly evolving into commercial products—attracting venture capital, strategic buyers, and unicorn valuations almost overnight. Yet in the world of tax and transfer pricing, this explosion of AI-driven value creation often outpaces legacy frameworks. Specifically, it challenges what qualifies as an “intangible” under existing legal and accounting definitions.

Traditionally, in software development, code was king—the primary form of intellectual property. But with AI, the value increasingly lies elsewhere: in the design, orchestration, and specifications that direct model behavior. These inputs—such as system prompts, fine-tuning protocols, and reinforcement strategies—are what shape an AI’s outputs and commercial performance.

“If you don’t have specifications, you just have a vague idea. The new scarce skill is writing specifications that fully capture intent and values…whoever masters that becomes the most valuable programmer. [T]his is going to be the coders of today.”

— Sean Grove, OpenAI

This shift reframes how we think about intangibles. Instead of static assets like source code or patents, companies are now generating value through strategic expression—the ability to define what an AI system should do, under what conditions, and why. Yet many of these assets remain undocumented, unregistered, and difficult to price—posing challenges for intercompany arrangements and tax compliance.

Under IRC § 367(d)(4), the U.S. tax code defines “intangible property” broadly to include:

- Patents, inventions, formulas, processes, designs, patterns, and know-how

- Copyrights and artistic compositions

- Trademarks, trade names, and brand names

- Franchises, licenses, and contracts

- Methods, programs, systems, procedures, campaigns, surveys, studies, forecasts, estimates, customer lists, and technical data

- Goodwill, going concern value, and workforce in place (including its composition and employment terms)

- And any other item the value or potential value of which is not attributable to tangible property or the services of an individual

This sweeping definition (especially complicated by “potential value”) captures not only traditional intellectual property, but also emerging and often hard-to-pinpoint assets—like internal datasets, proprietary frameworks, and organizational memory—especially relevant in AI-driven business models.

For transfer pricing purposes, the OECD Transfer Pricing Guidelines further clarify that an intangible is “something which is not a physical asset or a financial asset, which is capable of being owned or controlled for use in commercial activities, and whose use or transfer, would be compensated had it occurred in a transaction between independent parties in comparable circumstances”. But in the context of AI, where value is often co-created by distributed teams, autonomous systems, and third-party data, it becomes increasingly difficult to determine who actually owns or controls what—let alone how to price it.

AI-related IP: Blurred Lines, Tangled Rights

In the age of artificial intelligence, traditional definitions of intangibles—like patents, copyrights, and trademarks—are being stretched by a new generation of assets that are harder to define, harder to register, and harder to value. These include:

- Proprietary prompts and fine-tuning schemas

- Specialized training datasets and annotation pipelines

- Training inputs, including scraped or third-party content

- Embedded decision-making logic and prompt chains

- Institutional know-how tied to algorithmic workflows

- Emergent brand goodwill from AI-enhanced customer experiences

The following table compares “traditional intangibles” to what their AI counterpart might look like:

Table 1. Traditional vs. AI-Era Intangibles

| Traditional Intangibles | AI-Era Intangibles |

|---|---|

| Patents – Legally registered inventions | Proprietary prompts and fine-tuning schemas – Custom instructions that guide model behavior |

| Copyrights – Protected creative content | Training inputs – Scraped third-party content and public datasets used for model development |

| Trademarks – Brand names, logos, and trade dress | AI-enhanced brand goodwill – Emergent value from intelligent, personalized user experiences |

| Trade secrets – Confidential formulas or processes | Embedded decision-making logic – Algorithmic flows and prompt chains used in AI operations |

| Licenses – Contractual IP rights | Specialized datasets and annotation pipelines – Internal data curation pipelines with strategic value |

| Goodwill – Value tied to customer loyalty or brand equity | Institutional know-how in AI systems – Operational intelligence embedded in model workflows |

| Workforce in place – Skilled personnel contributing to ongoing operations | Agentic AI systems – Semi-autonomous agents performing planning, execution, and iteration |

| Going concern value – Ability of a business to continue operating and generate returns | Continuously learning models – Models that evolve through user interaction, improving with use and time |

These assets blur the lines between capital, labor, and software. They are often co-created across functions and jurisdictions, and rarely show up on balance sheets—yet they can represent the core value of an AI-driven business model.

The murkiness of IP ownership attribution is already playing out in third-party litigation. In Andersen v. Stability AI, artists allege their copyrighted works were used to train generative models without permission, prompting debate over whether training inputs constitute protectable intellectual property. Related cases against Midjourney and Anthropic center on the value of scraped content, prompt libraries, and model outputs—raising broader questions about what qualifies as an intangible asset in the AI economy. (see my LinkedIn post for an overview of these issues). These cases are working their way through district courts in California, but as any litigator understands, cases like these can take years to even get to the discovery phase. The pace of AI doesn’t allow tax law the luxury of waiting. The system needs to move faster—because value is being created (and shifted) in real time.

These disputes foreshadow the complexity tax authorities will face when evaluating intercompany transfers of similar AI-related assets. In many cases, it is almost impossible to disentangle value contributions made by third parties from those developed internally—posing serious challenges for transfer pricing when related parties are involved. The traditional tools for identifying, pricing, and attributing intangibles are not built for this level of functional entanglement.

The Human-Machine Collaboration Problem

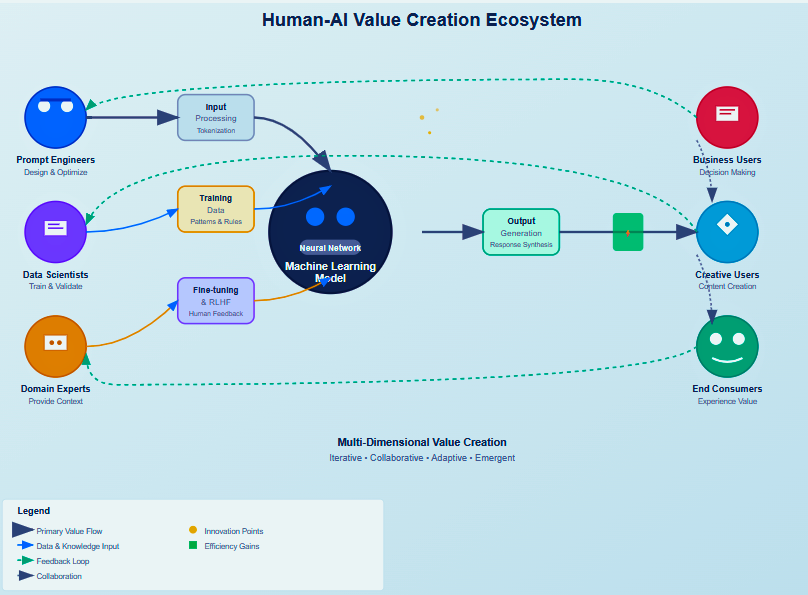

Under OECD guidelines, legal ownership of an intangible is a starting point for transfer pricing analysis—but not the end of the story. Ownership alone does not entitle an entity to retain all returns from exploiting the intangible. Instead, those returns must be allocated based on the functions performed, assets used, and risks assumed by all contributing members of the multinational group. Traditional transfer pricing assumes you can use FAR analysis to map SPFs or “significant people functions” to value creation.

This flowchart illustrates the often-invisible chain of events between AI training “inputs” and the final AI-generated output—spanning data ingestion, model training, inference, and filtering layers. It’s a visual shorthand for the legal and technical black box at the heart of generative AI debates: who contributes value, who controls the process, and who gets paid.

For a discussion of the different elements of the AI Value Chain and the uncertainty surrounding the tax and economic value that disappears when workers are replaced with an AI “ghost workforce” –>https://anant.us/blog/team-blog/article/when-ai-works-who-gets-paid/

But what happens when algorithms trained on global data perform significant portions of development, enhancement, and maintenance? Do we attribute functions to the AI itself? Should transfer pricing documentation include interviews with machine learning models alongside human engineers? At the same time, other value drivers—like market-specific advantages and group synergies—may clearly contribute to profitability.

This creation of value via group synergies may clearly enhance a multinational’s profitability, but might not be treated as intangibles for transfer pricing purposes—largely because it’s difficult, if not impossible, to assign legal ownership or control to any single entity within the group. But what happens when algorithms trained on global data—not people—carry out development or enhancement?

That’s where the DEMPE framework was meant to fill in the blanks. By focusing on the Development, Enhancement, Maintenance, Protection, and Exploitation of intangibles, DEMPE aimed to shift the emphasis from mere legal ownership to actual value creation functions. But in the context of AI, even DEMPE is being stretched beyond its limits.

DEMPE in an AI Context

The DEMPE framework (Development, Enhancement, Maintenance, Protection, Exploitation) provides a structured lens for identifying where value is created across an MNE. Today, AI-driven enterprises push the DEMPE framework to its limits. Consider this example:

Table 2. DEMPE in an AI World

| DEMPE Function | Entity / Location | Activity Description |

|---|---|---|

| Develop | U.S. Affiliate | Builds a foundation model trained on a legal corpus. Invests in compute infrastructure and engineering talent to establish core architecture. |

| Enhance | U.K. Affiliate | Fine-tunes the model for U.K. jurisdiction, tailoring outputs for local legal compliance. Develops internal prompt engineering guidelines. |

| Maintain | Canadian Team | Audits model outputs for hallucinations, monitors performance, and ensures explainability under AI regulatory standards. |

| Protect | Japanese Legal Function | Registers derivative IP (e.g., tuned parameters, prompt templates). Defines usage restrictions and manages cross-border legal risk. |

| Exploit | Singapore Affiliate | Deploys the model in client applications for contract automation and compliance workflows, generating revenue from AI tools. |

- Develop – A U.S. affiliate builds a foundation model trained on a legal corpus, investing in compute infrastructure and engineering talent to establish the core architecture

- Enhance – A U.K. affiliate fine-tunes the model for specific jurisdictions, customizing legal language outputs for compliance with U.K. case law and terminology. The team also develops internal guidelines on how to craft effective prompts

- Maintain – A Canadian team oversees model performance, auditing results for hallucinations and maintaining explainability standards under evolving AI regulations

- Protect – A Japanese legal function registers derivative IP elements (e.g., tuned parameters, prompt templates), defines usage restrictions, and manages legal exposure across jurisdictions

- Exploit – A Singapore affiliate integrates the fine-tuned model into client-facing applications for contract drafting and compliance workflows—monetizing the system directly

Importantly, human capital development—including internal training programs that build institutional AI expertise—represents a critical “Enhancement” function that generates operational know-how and increases the commercial utility of AI system. In this context, the DEMPE framework remains useful—but increasingly strained—as AI systems decentralize value creation and embed strategic inputs across functions, geographies, and even user interactions.

Headquarter Costs Without the Heads?

While much of the current transfer pricing debate around AI focuses on intangibles, another emerging challenge lies in allocating centralized stewardship and headquarter costs—typically based on headcount. As AI replaces or augments large swaths of human labor, traditional cost allocation keys may become outdated. And it’s not just fintech or software firms—legacy manufacturers like Ford are also weighing in. As Ford CEO Jim Farley bluntly put it, “AI is going to replace literally half of all white-collar workers in the U.S.” Recently, Glassdoor’s CEO has openly credited AI for job cuts in its workforce.

If machines are taking over core functions—while still relying on centralized services like HR or finance—it raises the question: should we rethink cost allocations to reflect machine-enabled output, rather than human presence alone?

Commensurate With Intelligence: When Benchmarks Fall Short

Traditional transfer pricing relies on the arm’s-length principle—often operationalized through comparable uncontrolled transactions (CUTs). These external benchmarks are supposed to reflect what independent parties would agree to in similar circumstances. But in the AI context, such comparables are often unavailable, unreliable, or economically irrelevant.

While some benchmarking exists—OpenAI’s API pricing, Anthropic’s enterprise packages, and public model leaderboards—these sources typically reflect surface-level licensing fees rather than the true commercial value of AI technologies integrated across business functions, geographies, or industries. Open-source access and public interfaces may offer a sense of pricing transparency, but they fall short when it comes to valuing proprietary models or deployment infrastructure embedded within enterprise workflows. In short, these are not transactions involving a company licensing or transferring its crown jewels—an event that would be unlikely, and nearly impossible to benchmark accurately in third-party markets.

According to the European Commission’s Joint Research Centre (JRC) study in May 2025, commonly used AI benchmarks were originally designed to measure technical performance in controlled environments—not to assess real-world economic utility or adaptability across commercial use cases. The study emphasizes that such benchmarks are typically optimized for competitive marketing purposes, not financial valuation or tax assessment. This makes them poor proxies for determining the fair market value of proprietary and evolving AI systems in a transfer pricing context.

In short: benchmarks may be visible, but they rarely reflect the depth, specificity, and dynamism of what’s actually being priced.

The U.S. Legal Backstop: Commensurate With Income?

The recent Tax Court decision in the Facebook case offers a pivotal interpretation of how U.S. courts are applying the arm’s-length principle in conjunction with the commensurate with income (CWI) standard under IRC § 482.

In its challenge to the 2009 cost sharing regulations, Facebook argued that Treasury had overstepped by allowing methods inconsistent with a strict arm’s-length analysis. But the U.S. Tax Court rejected that view, holding that Treasury has broad regulatory authority to define the contours of the arm’s-length standard—particularly when no reliable third-party comparables exist.

That point was further reinforced in the IRS’s 2025 Generic Legal Advice Memorandum (GLAM 2025-001), which underscores that even when taxpayers rely on CUTs, they may still face retrospective reallocations if actual outcomes diverge from projections. The GLAM notably downplays the weight of “realistic alternatives” and suggests that upfront pricing based on hypothetical market options does not shield taxpayers from adjustments tied to ex-post income performance. This position introduces new complexity to the best method rule—where outcome-based scrutiny may override comparability-based defenses, particularly in transactions involving high-value, data-driven intangibles like AI.

AI Agents and Anti-Scraping Licenses: A Possible Proxy for Value?

Yet even as foundational model benchmarking remains elusive, the emergence of agentic AI systems may offer a partial path forward. Unlike static generative models, agentic AI performs goal-directed workflows that more closely mirror human labor—often with commercial pricing and modular service delivery. As these agents proliferate across enterprise platforms, their observable functions, paired with the cost of the specialized human capital needed to develop and supervise them, may begin to offer workable proxies for value attribution. While far from perfect, this new layer of visibility could help align valuation practices with real-world deployments—bridging, at least in part, the gap between economic substance and available benchmarks.

In limited circumstances, licensing deals between publishers and generative AI companies—such as those struck by The Atlantic, News Corp, and Dotdash Meredith—could serve as external comparables for content-related intangibles. These agreements, which monetize access to proprietary data and editorial IP, may provide directional insights into how certain AI inputs (e.g., training datasets, promptable content frameworks) are priced in arm’s-length settings. However, their utility as transfer pricing benchmarks depends heavily on the nature of the intangible being transferred and the economic substance of the transaction—many such deals bundle distribution rights, usage restrictions, and brand affiliations that may not align with internal AI contributions across a multinational group.

AI and the Shifting Tax Landscape: What Comes Next?

Across jurisdictions, tax authorities are likely to scrutinize AI-related transfer pricing structures more aggressively—especially in the absence of reliable external comparables. For example:

- Training or fine-tuning activities conducted in one country may support reallocation of profits based on relative value contribution, rather than relying on standard licensing or API fee benchmarks.

- Insufficient documentation may prompt adjustments based on internal forecasts, usage metrics, or development roadmaps in lieu of flawed or unavailable market data.

- Custom AI implementations—particularly those incorporating user feedback loops, regional tuning, or localized compliance features—may be recharacterized to better reflect where value is actually created.

In parallel, the regulatory landscape is shifting. States now have the authority to regulate AI, and if history is any guide—particularly the wave of digital services taxes (DSTs) imposed globally—we may see more concrete efforts to tax AI directly, whether through state-level initiatives or federal legislation. Notably, the rationale for resisting the OECD’s international tax solution—particularly Pillar One—was often tied to concerns about preserving the competitiveness of U.S.-based AI and digital firms. That same concern may resurface in future discussions around AI-specific tax policy, especially as states begin asserting regulatory authority over AI and exploring new revenue models.

✅ Actions to Take Now

As AI value chains continue to stretch across borders and departments, transfer pricing teams should take the following steps:

- 📍 Map the Internal Value Chain

Identify where data, development, tuning, and feedback actually occur across the organization. - 🧠 Catalog Intangibles

Go beyond IP—include prompts, workflows, training datasets, QA protocols, and internal knowledge bases. - 📊 Apply DEMPE Thoughtfully

Align functional activity with economic contribution—not just legal ownership or contracts. - 🛡 Strengthen Benchmark Defenses

Build internal valuation models to justify pricing when third-party comparables are weak or absent. - ⚖️ Plan for Disputes Early

Use APAs (Advance Pricing Agreements), ICAP (International Compliance Assurance Programme), and robust documentation strategies to preempt regulatory challenges. - 🌐 Engage in Policy Dialogue

Actively engage with legislators and international organizations to shape the evolving application of tax law to AI.

Before You Go: Revisit the Bigger Picture

This article is the second in an ongoing series about AI, economics, and global tax rules. You can read the first piece, “When AI Works, Who Gets Paid?”, to explore how the AI value chain compares to traditional MNE structures—and why it’s already disrupting existing tax frameworks.

Final Takeaway:

In a world where machines co-create with humans and value emerges from interactions—not assets—transfer pricing must evolve from a compliance function to a strategic compass.

It’s no longer just about being “arm’s length compliant”—it’s about being future proof.

Lili Kazemi is General Counsel and AI Policy Leader at Anant Corporation. She advises on global legal, tax, and tech policy intersections—and is the founder of DAOFitLife, a performance and wellness resource for high-achieving professionals.